Since first thing on Friday morning Dave Murray has been charming a new generation of media messengers.

It is 14 years since the former Rangers owner and chairman slipped out of the spotlight, grasping a pound coin in his palm as 23 years of dubious business practises rebounded with interest on a club that went into liquidation just over a year later.

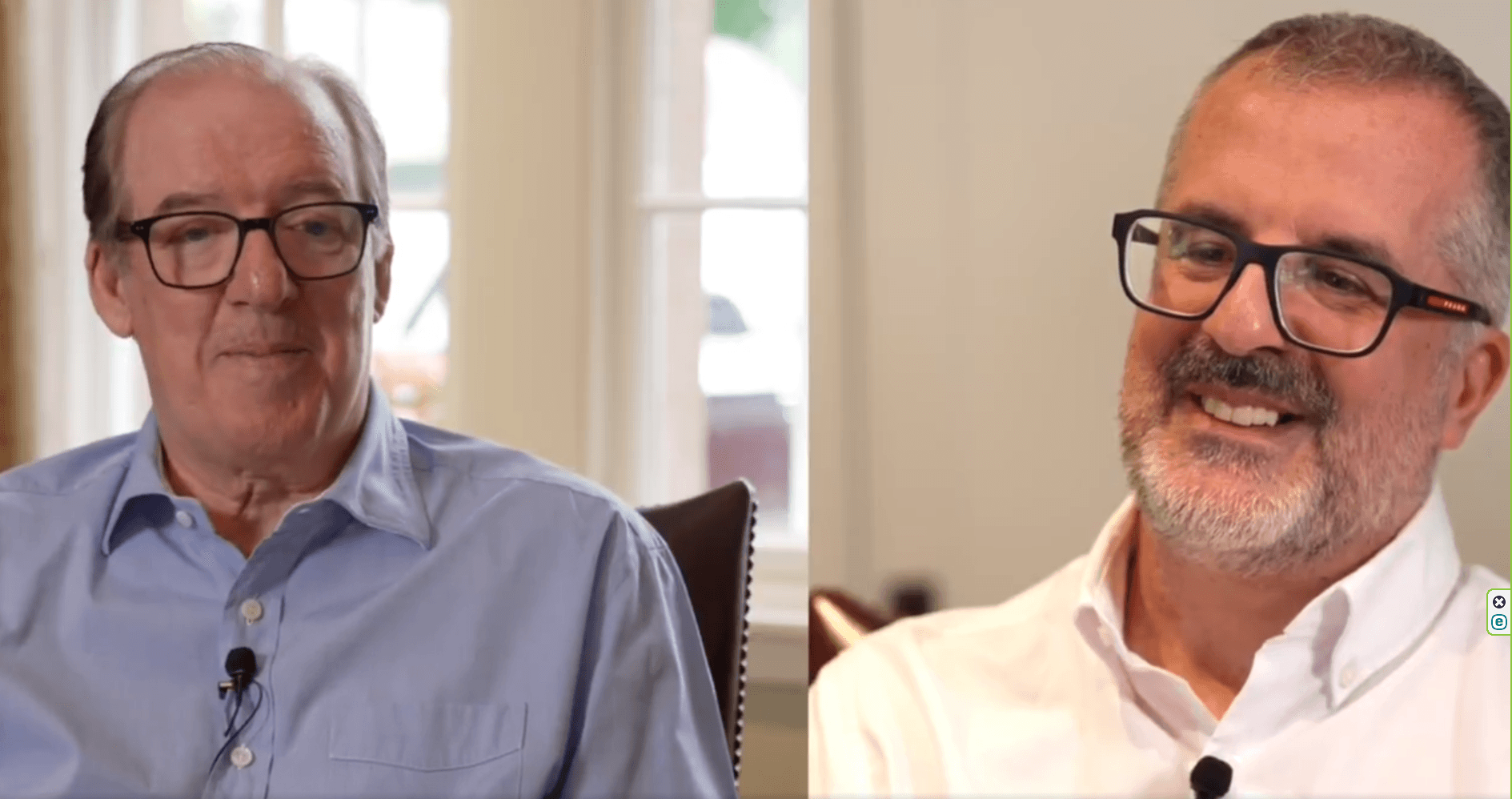

Led by Ewen Cameron of Bauer Radio and serialised by the Daily Record the ‘questioning’ has been pitiful as if those in the same room are in awe of being in the presence of a hero, the man that delivered the happiest days of their life.

A few competent questions were asked but follow ups to Murray’s replies were non-existent as he got off Scot free with a rewriting of history.

Some ridiculous answers went unchallenged, there was a claim that ATMs were on the brink of running out of cash alongside multiple distortions of footballing issues. Murray claims that he has been invited back by the owners of the club formed by Charles Green in 2012.

Rangers kept details of the side letters to key players like Barry Ferguson, Stefan Klos, Alex Rae, Billy Dodds, Steven Thompson, Neil McCann and dozens of others secret. HMRC only discovered them when the Met Police raided Ibrox in July 2007 as they investigated the transfer of Jean Alain Boumsong.

Apparently HMRC were gunning for the club for no reason, overlooking the fact that a £2.3m tax bill from the Discounted Option Scheme remained unpaid a decade later when Rangers went into liquidation. That bill dated back to the signings of Tore Andre Flo and Ronald de Boer.

At a tangent it has to be asked why HMRC never took court action to recover that money, were they afraid to upset the transfer plans of Rangers. Hearts were regularly dragged into Court over unpaid tax.

The biggest mistruth of all regards the so-called use of EBTs. Those schemes are legal but only by following certain guidelines.

If you promise them to new employees (players) with a side letter it isn’t an EBT it is disguised remuneration and liable to Income Tax and National Insurance.

Murray has been claiming that there was nothing wrong with his use of EBT’s, the Supreme Court ruling from 2017 nails that lie completely.

Rangers were throwing money into offshore trusts any which way they like with Murray being paid £6m for reasons unclear.

The Supreme Court decision

In their decision, the Court agreed with HM Revenue and Customs (HMRC) that the tax avoidance scheme used by Rangers Football Club doesn’t work. They said that Rangers should have deducted Income Tax and National Insurance contributions from payments they made to the scheme, which was an employee benefit trust (EBT).

In paragraph 39 of the Court’s decision, they set out the principle that employment income paid from an employer to a third party is still taxable as employment income.

What this means for similar disguised remuneration schemes

Note for Murray and those that interviewed him

HMRC’s view is that this principle applies to a wide range of disguised remuneration tax avoidance schemes, no matter what type of third party is used. This includes:

EBTs – including variants within these schemes where no loans are made from the EBT but instead the funds remain in, or are invested by, the trust

disguised remuneration routed through employer-funded retirement benefit trusts a range of contractor loans schemes

The facts of each case will determine where the earnings point arises based on decided case law.

What could happen if you use one of these schemes

HMRC intends to use this decision to take action against many of the disguised remuneration schemes using the full range of our available tools. This will include HMRC considering, in appropriate cases, whether to issue follower notices and, if relevant, associated accelerated payment notices.

It will also include accelerating litigation where users choose to continue challenging HMRC on their scheme.

What to do if you think you’re using a disguised remuneration scheme

HMRC strongly advises you to withdraw from the scheme and settle your tax affairs. You’ll avoid the costs of legal action and minimise interest and penalty charges on the tax you should have paid.

Strangely, or perhaps not none of those chosen to interview the former Rangers Chairman has referenced the Supreme Court ruling.

Maybe they were told that it was off the agenda or they didn’t want to upset the man that delivered the greatest period of success that they’ve ever known, whatever the means.

Every week in every game every opponent of Rangers from 2000 were playing against ineligible players lured to Ibrox with dual contracts, only one of which was sent to the SFA and SPL.

He buried Rangers. The cheats got what they deserved. 🧟♂️

— Tictop1888 (@toptim77) June 29, 2025

RELATED READING

- Celtic’s summer 2025 transfer news rolling blog

- The Tom Boyd comments on John Beaton that spooked the Ibrox messengers

The Qs unasked by @EwenDCameron

“Why was Ian McMillan asked to lie to HMRC?”

“Who told Ian McMillan to shred files & destroy evidence during an HMRC enquiry?”

“Why was Souness given an EBT by Rangers while not an employee?”

“Why did you demand anonymity at the FTT?”

1/2— Slimshady (@Slimshady1961) June 29, 2025

4 Comments

by Terence Nova

And then there was

IMPERFECTLY REGISTERED . Scandal of the highest order.

by Dando

Baxendale-Walker informed the duped Sir that his intended use of the EBT scheme would be illegal, he ignored the advice and the rest is history, as they say…….

HH

by Bryan Coyle

Cameron is a fudd his head is so far up his own arse he wouldn’t even hear the shite Murray was spouting.

by Magua

When the Supreme Court decision came out, it was the duty of Peter Lawwell, CEO of Celtic Football Club, to go after David Murray and everyone at Ibrox who held an EBT, in a court of law. He chose not to. Now we have a new situation, with the publication of Murray’s book. Will Lawwell go after Murray this time? I think we all know the answer to that question. As an aside, isn’t it strange that justice was finally done, when the case moved to England? Perhaps not. After all, David Murray was probably used to exchanging dodgy handshakes with members of the Edinburgh Establishment. This would of course, include High Court Judges.

Hail Hail.