It will cost more than £25m to sign Matt O’Riley from Celtic this summer, if that price is a bit rich you could buy up The Rangers International Football Club with change left over from £20m.

One of those purchases will get you a prime footballer showing every sign of following the sort of career path enjoyed by Virgil van Dijk who is considered among the five best defenders in world football.

The other will get you a decaying football stadium that has no timeline for when it will reopen, substantial debts to current Directors and a playing squad that couldn’t be given away as players dig in to retain their existing contractual terms.

Attempts by a friendly publisher to shame Sam Lammers into taking a 66% pay cut on the three remaining years on his contract have so far failed. Upto a dozen current players are in a similar situation while an entitled fan base scream for more spending on the latest Revolution!, being steered by the Belgian Beale in a bid to prevent O’Riley’s club from going beyond the 118 trophy mark.

While stories about Super Computers and UEFA coefficients are lapped up by legacy publishers it seems that news about the share values of two major Glasgow clubs is strictly out of bounds for fear of upsetting readers.

Transfer tales, tugs-of-war and all the rest are filling the webpages just now but as one club is valued at £250m and growing the value of their city rivals are falling through the floor at £18m as previous investors run for cover, happy for any consolation from their largely worthless shares

hhhhhhhhhhhhhhhhhhhhhhhhhhh

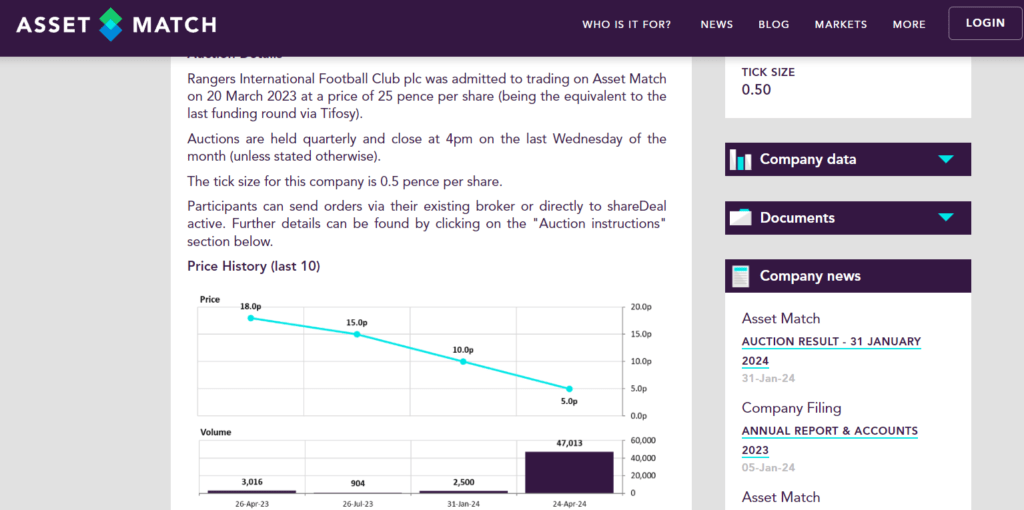

Despite the rapid decline in share value it seems that there has been a recent rush to sell shares in the club founded by Charles Green in 2012.

Mike Ashley and Ally McCoist were among the early investors paying one pence for shares in July 2012, in December loyal bears were urged to invest in a public listing with thousands shelling out at the offer price of 90p,

Like performances on the park it has all been downhill ever since, with doubts over the long term closure of Ibrox it is a brave or foolish punter that is buying up shares at five pence each in Rangers International.

Over the last three quarters 6.42m shares have been sold, during the current quarter 47m shares have been sold despite the price falling from 18p to just five pence. It seems that not everyone has faith in the leadership of Chairman John Bennett and the coaching brilliance of A Proper Football Manager.

With Ibrox closed for the foreseeable future matchday income will take a hit and although a favourable deal has been struck with the SFA there are still costs involved in staging home matches away from Ibrox.

Mixing that with a disillusioned support and angry Season Ticket holders about to allocated inferior seats at Hampden and you have the makings of a perfect storm although Scott Wright has pledged to stay and play for a new contract.

The downside of all this is that it appears that the Celtic board only need absolute minimal investment in the playing squad to remain the leading team in Scotland.

Ambitions to achieve mediocrity in the Champions League seem out of bounds with no improvement in the Celtic squad over the last four transfer windows.

One Champions League victory over the last six years is a horrendous record for a club that claims to have European ambitions but with a multitude of problems across the city Chairman Peter Lawwell can point to the company share price while handing out the bonuses to his executive team. Bonuses are decided by the elderly Remuneration Committee.

NOTE: Trading in the old Rangers club were suspended on 9 January 2012, in February the club went into administration with the liquidation process starting in June 2012.

CLICK HERE for the main shareholders in Rangers International.

CLICK HERE for Ibrox messenger lets slip over December re-opening.

CLICK HERE for Ibrox closure announcement.